If the attempted merger between PayPal and Pinterest left you scratching your head, a comment coming out of Coinbase CEO Brian Armstrong could offer another clue about the future of online photo sharing platforms.

If the attempted merger between PayPal and Pinterest left you scratching your head, a comment coming out of Coinbase CEO Brian Armstrong could offer another clue about the future of online photo sharing platforms.

“There was a question there about the social experience, and I think that’s something that Coinbase can bring to the table here,” Armstrong said during the company’s Q3 earnings call in regards to the upcoming release of their NFT platform. “You know, we’d like to make the Coinbase NFT a little bit more like, you know, Instagram as opposed to say an auction like eBay or something like that.”

Armstrong continued by saying that their NFT platform will allow people to follow their favorite artist and creators, while offering a “feed of content that is populated from those people you follow.”

“In addition, you can go in there and buy an NFT if you really like it and kind of showcase in your own social profile,” Armstrong said.

Coinbase’s primary competitor in the NFT marketplace would be OpenSea, a business that recorded $3.4B in transaction volume in August.

Coinbase was mostly mum about its crypto competitors except to say that “there are companies like PayPal and Square and Robinhood and traditional financial institutions who are entering and we believe that that’s a huge validation of the whole space.”

I attended NFT.NYC in Times Square on Wednesday and was blown away by the amount of energy around not only NFTs, but blockchain technology. For the first time, people like street-artists and musicians who rarely take an interest in investing are now developing a liking to extremely niche, complex, and heavily unregulated investment platforms. In a mix of Silicon Valley tycoons and seemingly broke college students trying to make it big, I poked around NFT.NYC and tried to figure out how any of this stuff could be useful to the traditional financial world.

I attended NFT.NYC in Times Square on Wednesday and was blown away by the amount of energy around not only NFTs, but blockchain technology. For the first time, people like street-artists and musicians who rarely take an interest in investing are now developing a liking to extremely niche, complex, and heavily unregulated investment platforms. In a mix of Silicon Valley tycoons and seemingly broke college students trying to make it big, I poked around NFT.NYC and tried to figure out how any of this stuff could be useful to the traditional financial world.

Here’s what I found.

-Blockchains Have Potential

In terms of record keeping, a blockchain’s ability to function as a ledger is the first thing that comes to mind in terms of real world practicality. There are companies out there that are attempting to put mortgages on the blockchain through things like NFTs, but no one at the event was talking about banking documentation. Things like loans, credit history, customer information, and merchant history all would thrive in an objective virtual record keeping database that could cut data processing and approval times into fractions of what they are now. Imagine having all of the information needed for a deal in one place, accessible by anyone that had the credentials to get it?

-These Companies want Cash

With the amount of money in the crypto world being thrown around, startups are popping up everywhere to try to get their piece of the action. With gaudiness and flamboyance being the marketing technique that’s dominating how these companies talk about what they do, it is clear that the key to starting a successful company in the crypto space is how quickly you can legitimize your company to your customers. If lenders are looking to expand their marketshare, this is the place to look. A lender, who will remain unnamed, was handing out business cards at the main showcase of NFT.NYC, and said “we are here looking for opportunities.” There is a huge potential for funding an entire industry in this space, and it seems as if lenders haven’t quite caught on yet.

-It’s marketed by Gen Z, but Operated by ex-Wall Street

The mix of people who work for these companies is interesting. Outside of the Gen Z people talking about the notion of monetizing art and creativity, it seems the X’s and O’s of the industry are being run by a large portion of former Wall Street people. I met former commodity traders, investment bankers, stockbrokers, and hedge fund people that left that world to get into crypto; and it seems like they’re the ones running the books of these companies.

-Learn what an NTT is

-Learn what an NTT is

A non-transferable token is what one CEO told me will innovate the everyday processes of finance more than anything else in the crypto space. Although he described it as an up and coming, abstract part of blockchain technology, the individual said that these types of tokens give access to information on the blockchain on a one way-basis, primarily eliminating the ability for anyone to access personal information if stored on a blockchain. He said this is an extremely mind boggling topic for most, even in the crypto space, and is largely not talked about because of the complexity of its nature. As more people work with NTTs, this CEO claims that anyone in the field of moving, borrowing, or lending money in the future will be working with NTTs on a daily basis.

-Digital Art is Part of the Hype, the Value is in the Technology

When people hear NFT, they associate it with a JPEG of a funky design that can be purchased and viewed solely the internet. This is true, but will not be the future of this type of technology. The artists who are trying to promote digital arts via NFTs are there to profit off of the hype of the space. The idea of buying a virtual picture for half a million dollars, which actually happened at the event, is just a combination of the excitement around the industry, and it’s widespread financial boasting mentality. The concept of a fully independent, tamperproof form of virtual record keeping that can be used by financial companies to speed up everyday processes is where the ones who have the most knowledge about finance that work in the crypto space are keeping their focus.

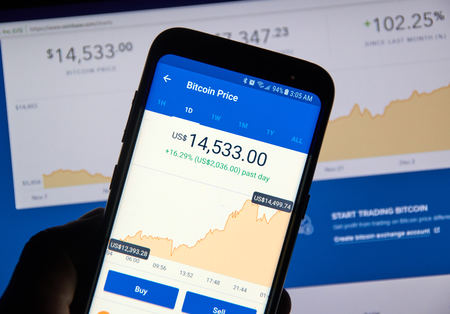

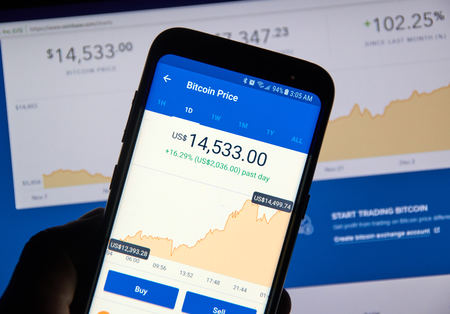

Bitcoin fell about five percent yesterday to below $7,000 after Business Insider published a story saying that Goldman Sachs is dropping its plan to open a trading desk dedicated to cryptocurrencies. The Business Insider story made this claim anonymously, citing people familiar with matter.

Bitcoin fell about five percent yesterday to below $7,000 after Business Insider published a story saying that Goldman Sachs is dropping its plan to open a trading desk dedicated to cryptocurrencies. The Business Insider story made this claim anonymously, citing people familiar with matter.

Update: Goldman Sachs CFO Martin Chavez discounted the Business Insider report on Thursday, calling it “fake news” at the TechCrunch Disrupt Conference in San Francisco.

“I never thought I would hear myself use this term but I really have to describe that news as fake news,” Chavez said on stage at the conference.

Chavez said Goldman is working on a type of derivative for bitcoin because “clients want it,” according to CNBC.

“The next stage of the exploration is what we call non-deliverable forwards, these are over the counter derivatives, they’re settled in U.S. dollars and the reference price is the bitcoin-U.S. dollar price established by a set of exchanges,” Chavez said.

The value of Bitcoin has continued to drop today, losing $1,000 in a 24 hour period. It is now at $6,409.30, according to CoinDesk.

A May 2018 story in Fortune indicated that Goldman Sachs had plans to open a Bitcoin-trading business in June of this year. That was postponed and it now seems that these plans have been shelved indefinitely. The sources in the Business Insider story said that Goldman Sachs sees the regulatory environment as ambiguous regarding cryptocurrencies.

In a tweet from the bank’s CEO Lloyd Blankfein last October, he wrote, “still thinking about bitcoin.” And he later said, according to CNBC, “No conclusion – not endorsing/rejecting. Know that folks also were skeptical when paper money displaced gold.” It seems that there is still no conclusion.

When asked if the assertions in the Business Insider story are true – that plans for a cryptocurrency desk have been scrapped – Goldman Sachs representative Michael DuVally responded with the following comment: “In response to client interest in various digital products, we are exploring how best to serve them in the space. At this point, we have not reached a conclusion on the scope of our digital asset offering.”

Stephen Horan, Managing Director for General Education and Curriculum at the CFA Institute

Stephen Horan, Managing Director for General Education and Curriculum at the CFA InstituteThe CFA Institute, which creates the curriculum for the annual Chartered Financial Analyst (CFA) exams, has recently added cryptocurrencies and blockchain as topics for to its tests that are known for their difficulty. The tests are administered in over 170 countries, typically the first weekend in June, with an additional test for certain test takers in December.

Passing these exams provides a significant advantage to financial professionals like research analysts and portfolio managers who want to advance in their careers. There are three levels of exams. Over the past several years, Stephen Horan, Managing Director for General Education and Curriculum at the CFA Institute said that only 43 percent of test takers pass level 1. The level 1 exam weeds out the bulk of test takers and the pass rates for level 2 and level 3 tests are slightly higher. Ultimately, though, Horan said that less than 20 percent of those who start the CFA program pass all three exams.

Horan told deBanked that the institute decided to add cryptocurrencies and blockchain to the curriculum for level 1 and 3 curriculums because they got feedback from people working in the industry that it was relevant.

“We started to hear that this is now mainstream, it’s not fringe,” Horan said.

As for the nature of what will be put in the curriculum, Horan said they are not making judgments whether cryptocurrencies are good or bad, but rather posing questions like “What are the functions of a currency?”

The new material for the 2019 exam will not be released until August. The six hour long exams have been given since 1963 and test takers generally study 300 hours for each exam.

This development is surely a sign that cryptocurrencies and blockchain technology have entered the mainstream. While suspicion about both of these technologies remains, it seems that they are here to stay.

This development is surely a sign that cryptocurrencies and blockchain technology have entered the mainstream. While suspicion about both of these technologies remains, it seems that they are here to stay.

Horan said that 279,000 people took one of the three exams last year, and these numbers have been steadily rising. More than 40 percent of test takers are in the Asia Pacific; within this region, one-third of these people are in China. Currently, about 150,000 have passed all three tests and they can call themselves “charter holders.”

Horan said that some companies require that their employees have passed all or of some of the CFA exams, such as the investment management firm Eaton Vance. He also said that Fidelity is a big adopter of the CFA exams.

In addition to creating the exams, the CFA Institute also has a membership of finance professionals that supports continued education and networking. The company has 600 employees worldwide and is headquartered in Charlottesville, Virginia.

If the attempted merger between PayPal and Pinterest left you scratching your head, a comment coming out of Coinbase CEO Brian Armstrong could offer another clue about the future of online photo sharing platforms.

If the attempted merger between PayPal and Pinterest left you scratching your head, a comment coming out of Coinbase CEO Brian Armstrong could offer another clue about the future of online photo sharing platforms.

-Learn what an NTT is

-Learn what an NTT is Bitcoin fell about five percent yesterday to below $7,000 after Business Insider published a story saying that Goldman Sachs is dropping its plan to open a trading desk dedicated to cryptocurrencies. The Business Insider story made this claim anonymously, citing people familiar with matter.

Bitcoin fell about five percent yesterday to below $7,000 after Business Insider published a story saying that Goldman Sachs is dropping its plan to open a trading desk dedicated to cryptocurrencies. The Business Insider story made this claim anonymously, citing people familiar with matter.

This development is surely a sign that cryptocurrencies and blockchain technology have entered the mainstream. While suspicion about both of these technologies remains, it seems that they are here to stay.

This development is surely a sign that cryptocurrencies and blockchain technology have entered the mainstream. While suspicion about both of these technologies remains, it seems that they are here to stay.